Last week, I wrote about creating a return on investment (ROI) for customers. Unlike customer satisfaction, focusing on customer ROI gets to the heart of renewals in a recurring revenue business. Customers may be satisfied with your product or service, but if they are not seeing adequate financial return they are unlikely to renew. I saw a recent post on LinkedIN that spoke about employee ROI, and it got me thinking.

The tech industry has seen massive reductions in headcount across the board from large employers to small. I read numerous posts from former employees who were caught in the downsizing, and were totally surprised. Terminations for cause or failure to perform should never be a surprise, but corporate reductions in force are often surprising. For the suddenly terminated employee, the question is always ‘why me?’

Reductions in force are typically driven by the need to improve profitability, or to restructure as a result of a strategic pivot. Of course, there are always staffing decisions related to ‘death’ and ‘marriage,’ better known as bankruptcy and M&A, but run of the mill reductions in force (RIF) are what typically leave terminated employees surprised. I have read all sorts of comments like “this was the best job I every had,” or “my manager just told me how much they appreciated me,” or the worst of all “I was just promoted and given a raise, and then this…”

What is the calculus that is leading an employer to choose one employee instead of another? When I wrote about customer ROI and churn, I proposed that there are really two separate scales involved. One is satisfaction, and the other is financial return on investment. Customers can be satisfied, but just not see the economic value. In a RIF, there is a similar calculation being made. An individual may be a ‘good’ employee, but not in a role where they are contributing more than they cost. This is not a simple financial calculation because there are many factors that influence how a manager evaluates contribution, but in the end it can be thought of as employee ROI.

The employee shock factor arises when they cannot see the handwriting on the wall. Despite solid performance reviews, they miss the signs that their contribution is not adequately benefiting the bottom line, or an awareness that in a down-draft their role may not meet the bar for retention. When an organization has decided to cut employee costs to a defined level, managers are forced to make decisions about which individuals’ contribution outweighs their cost.

So what can an employee do to avoid being swept up and surprised by a RIF? Sometimes, the answer is nothing at all, but just like a vendor needs to understand the calculus and strive to create a positive ROI for customers or face churn, employees need to focus on their ROI contribution to their employer. It starts with candid probing conversations between the manager and employee about how contribution is being measured. Is the current role the highest and best use of the employee’s talents? Is the current role core to the business, or peripheral to the mainstream? What can the employee do to become more valuable to the business?

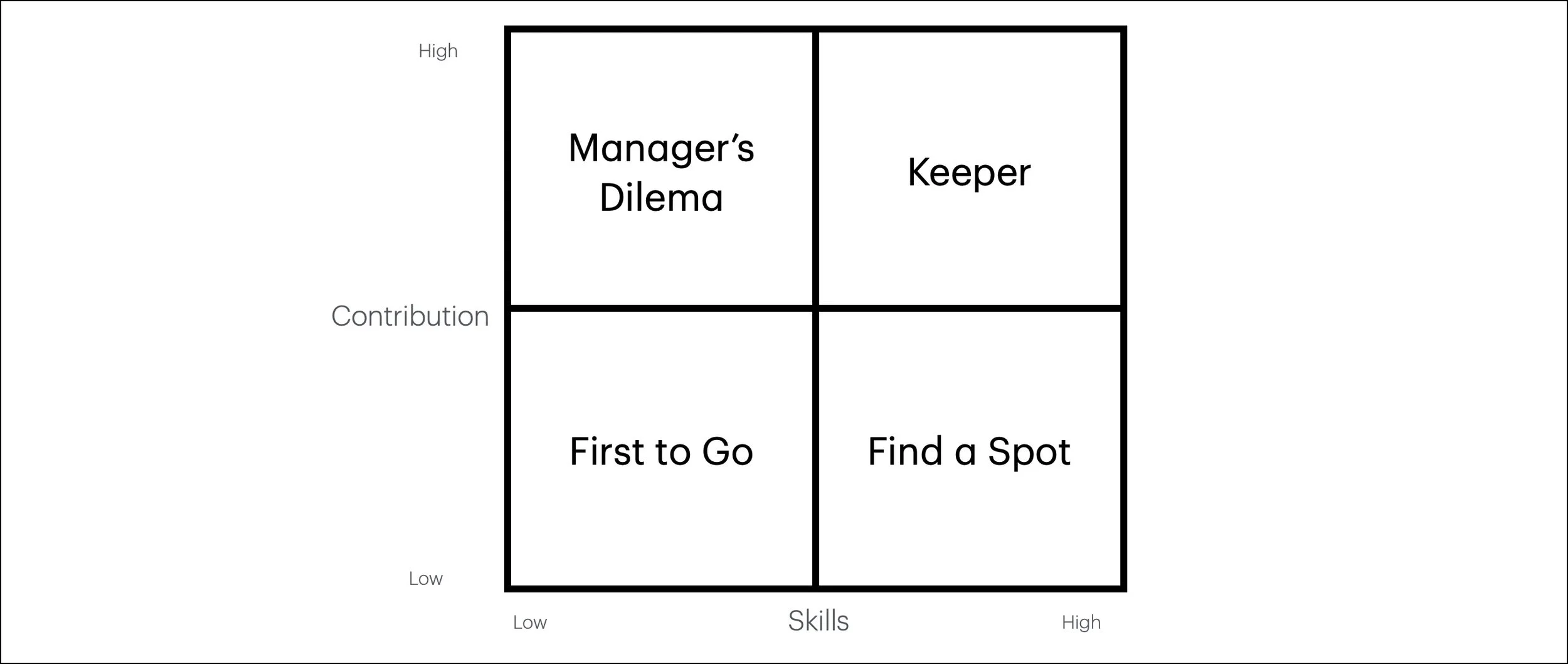

Employees need to have ‘spidy senses’ about how the business is performing, and how they are personally contributing to success. They need to develop situational awareness and EQ about how they are interacting with others, and if they are seen as a ‘go to’ resource or a siloed contributor. Working with their manager, the employee should take an inventory of their skills and determine how they can diversify or stretch to become more valuable. In a RIF environment, managers are often looking for employees that can do ‘more’ in favor of employees that are siloed or narrow in their skills. One way to think about the manager’s calculus is to place each employee on a 2-by-2 grid charting contribution and skills.

Low contribution and low skills are ‘First to go.’ High contribution and high skills are the ‘Keepers.’ Low skills and high contribution create a dilemma for the manager because it is an indication that the employee is maxed out, but they are good at their job, so they may be hard to replace. Employees in the final quadrant are the employees that have low contribution but high skills. Most managers will try to find a spot where this individual can become more effective, but if the manager perceives that this is simply an employee who is not striving to contribute, that may be a ticket to a RIF.

Nobody wants to manage through a RIF, and nobody wants to be the ‘surprise’ victim of job loss, but more and more it is a fact of business life. Employees can help make themselves more bullet-proof by focusing on the ROI their employer is getting from employing them. Managers can help employees avoid the door by coaching them to expand their skills and contribution to become go to resources, and more RIF-proof. Individuals need to be aware of the ROI they are creating for their employer.